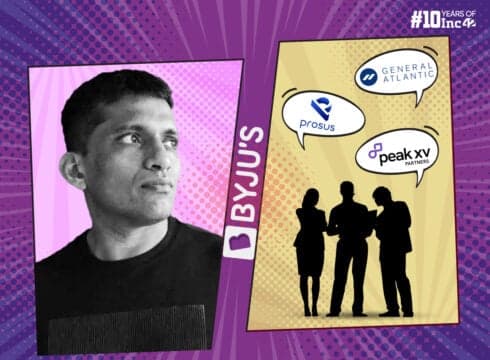

The NCLT directed embattled edtech giant BYJU’S to maintain status quo with regard to existing shareholders and their shareholding

The bench was hearing a plea filed by General Atlantic Singapore and Sofina S.A. against the edtech giant, accusing of floating a second rights issue

The Tribunal also restrained BYJU’S from going ahead with the second rights issue till the petition against the first rights issue is disposed of

The Bengaluru bench of the National Company Law Tribunal (NCLT) has directed embattled edtech giant BYJU’S to maintain status quo with regard to existing shareholders and their shareholding.

A DEEP DIVE ON INDIA’S TECH & STARTUP ECONOMY

Join our exclusive community of business leaders & makers for in-depth tech stories and intelligence on India’s tech economy, you won’t find elsewhere.

Companies who trust us

9,999

₹4,999

Annual Membership

1 YEAR OF unlimited ACCESS

- No Paywalls, Unlock All Content

- Premium Content & Newsletters

- Free Access To Virtual Events

- 50+ Industry Reports

- $250,000+ Of Startup Deals

Companies who trust us

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

The Bengaluru bench of the National Company Law Tribunal (NCLT) has directed embattled edtech giant BYJU’S to maintain status quo with regard to existing shareholders and their shareholding.

The bench was hearing a plea filed by General Atlantic Singapore and Sofina S.A. against the edtech giant for violating the Tribunal’s earlier order on its $200 Mn rights issue.

In its order dated February 27, the NCLT asked BYJU’S to not allot shares without increasing the authorised share capital of the startup and to keep the funds received via the rights issue in a separate escrow account till the disposal of the matter.

The petitioners argued that BYJU’S proposed a second rights issue by way of an offer letter dated May 11, which opened on May 13 and is scheduled to end on June 13.

Following this, the Tribunal restrained BYJU’S from going ahead with the second rights issue till the petition against the first rights issue is disposed of.

“The Respondents (BYJU’S) are further directed to keep the amounts collected so far since opening of the second rights issue in relation to this offer in a separate account which should not be utilised till the disposal of the main petition in CP No. 18/BB/2024. Further, status quo with regard to existing shareholders and their shareholding shall be maintained till the disposal of the main petition,” the Tribunal said in its order.

The NCLT has scheduled the next hearing in the matter for July 4.

Meanwhile, sources at BYJU’S told Inc42 that there is no second rights issue and the latest right issue being referred to by the investors is an extension of the previous $200 Mn rights issue.

They added that while BYJU’S received commitments worth over $200 Mn for the rights issue, it was able to close it partially as some of the commitments didn’t translate to fund infusion. As a result, the company floated the new offer.

The development comes at a time when BYJU’S is fighting multiple legal cases in various courts in India and the US. Its disgruntled investors have argued that the company violated the NCLT’s February order.

In its latest order, the Tribunal also directed BYJU’S to file the complete details of the allotments made on March 2 before the increase of authorised share capital within 10 days. Besides, the court has also asked the company to disclose the complete details of the escrow accounts in which it is parking the funds raised via the rights issue.

During the hearing, the counsel for the investors also brought up the multiple trials that the company has been facing. Senior Counsel Sudipto Sarkar highlighted that while the Enforcement Directorate (ED) and Ministry of Corporate Affairs (MCA) are actively investigating the company’s affairs as of now, the company is also under scrutiny for syphoning $533 Mn from its $1.2 Bn Term Loan B lenders.

Apart from these ongoing legal proceedings, the company is also facing an insolvency plea from OPPO Mobiles, the Board of Control for Cricket in India (BCCI), outsourcing firm Teleperformance Business Services, and IT service provider Surfer Technology.

Key Highlights

Funding Highlights

Investment Highlights

Acquisition Highlights

Financial Highlights

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.